Innovation R&D | Upstream Digitalization

Edited by Journal of Petroleum Technology – Judy Feder, JPT Technology Editor

UPSTREAM DIGITALIZATION IS PROVING ITSELF THE REAL WORLS

At its most basic, digitalization is about creating value from data. For the upstream industry, where even a 1% improvement in efficiency or production can drive huge financial results, there is no question that the size of the digital prize is huge. So are the challenges.

“The demand people increasingly make now when presented with … digitalization … is, ‘prove it works,’” said Gareth Smith, head of consulting for Sword Venture. “They want to see solid examples of real value, not just a PowerPoint promise.” And, that is starting to happen at growing scale.

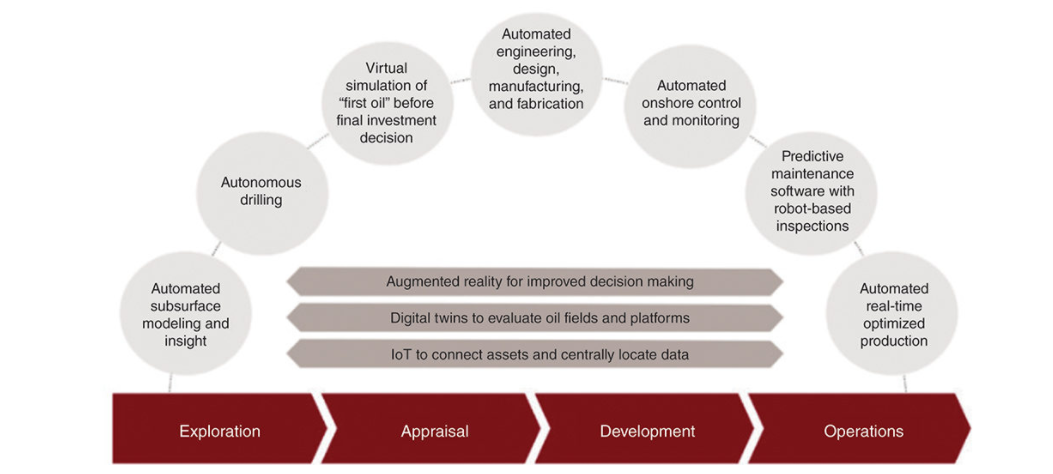

There is a reason that 92% of survey respondents for DNV-GL’s 2020 oil and gas industry outlook said they expect to increase or maintain levels of spending on digitalization in 2020: Digital technologies combined with data-driven insights are transforming operations, improving efficiency, boosting agility, and enabling strategic decision-making at numerous points along the E&P value chain (Fig. 1).

Fig. 1—The digital asset life cycle. Source: Aker BP, Cognite, and Strategy& research.

For example, scaling digital solutions across Equinor’s global portfolio faster than expected delivered cash flow impact of more than $400 million in 2019—primarily from earlier startup of Johan Sverdrup and increased uptime on assets connected to its integrated operations center—and enabled the company to increase its 2025 efficiency improvement ambition from $2 billion to $3 billion.

Using the Cloud To Turn Big Data Into Smart Data

One of the key enablers of data-science-driven technologies for the industry is its ability to convert big data into “smart” data, said Vural Sander Suicmez, Middle East region manager for QRI. The ability to not only feed data into the cloud, but also retrieve information from it, makes it possible to conduct analytics that add a layer of insight on top of the data.

“The cloud is opening all sorts of opportunities to do data analytics on it, and not just from a single facility, where most of our work is done today, but globally,” said Ed Moore, senior technologist for Chevron’s Emerging Technologies Group. “Looking at a larger sample size can provide new insights about how to operate.”

Since August 2019, Chevron has leveraged edge computing and data analytics to directionally drill more than 3 million ft remotely in its Mid-Continent business unit and is now using remote drilling for 100% of its directional drilling in the unit. The company is also using predictive analytics with either artificial intelligence (AI)-based algorithms or first-principle engineering models to monitor its wells in remote locations and to know earlier and respond faster if they start to lose production.

Predictive maintenance with digital twins. “Digital twin is a broad term,” explained Moore. “The engineering version of digital twin is an example of AI that allows us to simulate how a piece of equipment is working. This helps us determine when the equipment will start to not operate as efficiently as needed, which in turn helps us schedule maintenance to maximize the life of the equipment while saving downtime,” Moore said. Through a partnership with Emerson and Microsoft, Chevron is applying the engineering digital twin concept to extend the life of its heat exchangers to a major turnaround. The exchangers are designed with software that em-beds all the engineering aspects, then tells how much heat they can exchange, based on engineering thermodynamics.

“It’s like our cars. We used to take them for maintenance every 3,000 miles; now embedded sensors and predictive analytics let us know when we’re nearing maintenance time—for example, 12% of engine oil time left. The same principle applies whether it’s a pump or a platform,” said Moore.

Chevron also uses a CAD-type, augmented-reality (AR)-enriched version of digital twin to help field workers and subject matter experts working in an office or other location collaborate remotely in real time to monitor and redress or improve equipment. Using Microsoft HoloLens glasses and MS Virtual Assist, integrated with Chevron’s Skype and Teams infrastructure, the collaborators can work together in 3D virtual space around the actual piece equipment (Fig. 2).

Fig. 2—Using augmented reality in the form of HoloLens helps Chevron field and office workers “look at” what they are working on together in real time to monitor and quickly redress or improve equipment.

“This AR equipment can pay for itself in one saved international flight,” said Moore.

Total, Aker, BP, Shell, and Equinor have also developed and deployed digital twins. Equinor created a digital twin of its entire Johan Sverdrup platform. The company is also using the concept during drilling under challenging circumstances such as when using managed-pressure-drilling techniques.

BP uses its APEX simulation and surveillance system to create virtual copies of all its production systems. By pairing the model with the actual data, irregularities can be detected hourly, and the impact of procedures can be simulated to show engineers how they can tweak flow rates, pressures, and other parameters to safely optimize production. Piloted in the North Sea, APEX is now being rolled out around the world. The company says the system helped add 30,000 barrels of production last year. In one instance in Trinidad and Tobago, the company had to shut in a pipeline for maintenance at its onshore facility. By simulating the procedure and showing engineers how to reroute the flows and at what speeds, BP says it was able to protect a large volume of production that previously would have been lost during the 3 days required to complete the maintenance.

Artificial Intelligence Brings Real Benefits to Seismic Interpretation

Machine learning (ML) is the computational aspect of artificial intelligence (AI) that uses knowledge discovery, pattern recognition, and data mining to learn automatically from data and develop predictive work flows. With its parallels to consumer AI processes such as facial recognition, ML is moving seismic interpretation toward reducing risks and helping to identify new prospects.

- Shell cites GeoSigns, its proprietary seismic imaging and interpreting software suite, as instrumental in its discovery of 10 million barrels of oil beneath subsurface structures in the Demios field in the Gulf of Mexico.

- BP based the go-ahead for its Gulf of Mexico Atlantis Phase 3 development on “breakthroughs in advanced seismic imaging and reservoir characterization” that revealed an addition 400 million barrels of oil in place.

- An ambitious collaboration project by Chevron, Schlumberger, and Microsoft is aimed at visualizing, interpreting, and obtaining meaningful insights from data sources across exploration, development, and production and midstream sectors.

Spreading the Benefits

“Many key industry players are setting optimistic goals [for digital], realizing these goals depend on how freely data is shared among companies and how commercial strategies are deployed to drive this development,” said Audun Martinsen, Rystad’s head of oilfield research.

There is also backlash among operators who are tired of being locked into solutions with data models that are limiting because the cost of change is too high.

Jim Crompton, professor of petroleum engineering practice at Colorado School of Mines, believes that thus far with digital, the industry is digging the silos deeper. “The impact of digitalization on drilling has been to drill better wells, but we need a cultural shift to look at the entire asset,” said Crompton. “Digital 1.0 has done well on a project basis, but not on an asset basis. To achieve long-term asset management, we need to collaborate to work across functions,” he said.

Sentiments like these are guiding a paradigm shift that is driving vendor-neutral open-source data-sharing platforms such as the Open Subsurface Data Universe (OSDU), which will be focused on developing a standard data platform to integrate exploration, development, and wells data. Announced in August 2019, a portion of OSDU will be made commercial later in 2020.

Schlumberger has come on board with its GAIA digital subsurface platform, which is a data-as-a-service offering. Schlumberger and IHS Markit are bringing their seismic and well data to the platform. Schlumberger is also partnering with other companies to provide access to structured data—seismic, wells, and production—as well as unstructured content such as news and market reports from multiple content providers across the E&P life cycle.

“Anyone will be able to deploy the OSDU data platform—as it will be open-sourced—to build software solutions on top of it,” said Seabrook.

Along with GAIA, Schlumberger has launched the DELFI cognitive E&P environment, an ambitious digital ecosystem with cloud-native solutions designed to remove silos across the E&P value chain. ExxonMobil is using its drilling planning tool, and Woodside has signed on to an enterprise deployment.

“Companies are adopting digitalization at different levels of engagement,” said Seabrook. “For example, small companies can leverage the cloud through ecosystems like DELFI, without having to negotiate with cloud providers, even for applications as granular as telling a pump how to function.”

Unlocking the Value

AI is a completely different way of solving problems from the complex-mathematics and first-principles-physics approach petroleum engineers have used for the past 30 years to understand and optimize oil- and gas-producing reservoirs, says Shahab Mohaghegh, professor of petroleum and natural gas engineering at West Virginia University. The math behind AI is simpler than that for complex engineering, but AI involves neuroscience, philosophy, and other disciplines outside the engineering scope, explains Mohaghegh, and the lack of understanding around it can breed resentment, uncertainty, and fear.

AI and other aspects of digitalization will make engineers’ jobs easier, not replace them, according to Troy Ruths, founder and CEO of Petro.ai. “AI is not the insights at the top of the E&P ‘food pyramid’ that some engineers fear. Instead, it’s the enabling foundational layer—the ‘smart assistants’ that do mundane tasks,” said Ruths. “Machines can’t learn on their own. You must understand the domain to do the transformations. That is the realm of engineers.

“Look at it like Ford, breaking manufacturing into interchangeable parts and developing workstations along the assembly line. The benefit of a digital analytics assembly line is that it enables a more consistent knowledge product at the end,” Ruths said. He contends that reservoir engineers shouldn’t need to know how to build more than very elementary databases.

“The idea that engineers need to completely retrain to use the new AI layer is actually the opposite of the reality: think of how easy it is to use Alexa or Google Home,” he said.

“Neuroscience is to the digital revolution what machines were to the first industrial revolution. Machines mimicked what muscles do to help manufacturers. Digitalization mimics what brains do to help petroleum engineers. That is what our industry needs to understand, accept, and leverage to unlock its value,” said Mohaghegh.

Time Is No Longer Everything

Ruths disagrees with the idea that the industry is “stuck in pilot purgatory” with regard to digitalization. In fact, he believes the current price environment is an opportunity for everyone to stop and take a breath and set aside the hype.

“We need to work specific problems and show the value in that versus presenting or looking at a panacea or overnight business solution,” he said.

L.E.K. Consulting Principal Stuart Robertson agrees. “Unlike the tech industry, where ‘fail fast and often’ is the mantra, or the retail industry, which has perfected techniques like A/B product testing, the cost of failure for the oil and gas industry restricts the amount of experimentation companies can afford to undertake and pushes them toward a focus on high-quality solutions,” he said.

The complexity of engineering required to develop industry solutions means that AI approaches often need to be deployed into highly sophisticated situations, with multiple variables at play. What’s more, many activities, such as developing a field, happen relatively infrequently.

“Approximately 20,000 onshore wells are drilled in the United States per year—contrasted with 150 million Visa transactions per day. So, obtaining data at the required scale for many algorithms, such as deep learning, can be difficult,” Robertson said.

“Finally, available data is often highly commercially valuable, so the incentives for sharing it across the industry can be low. Given all these factors, it is hardly surprising that the number of activities for which AI will be highly effective is relatively low compared with other industries. But when AI is applied to the appropriate areas, its impact is likely to be considerable,” he said.